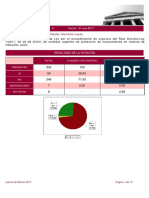

Netherlands

Date:

08/10/2014

See notes at the bottom of the table for definitions

Part 1 : Net revenue/cost for general government (impact on government deficit)

Millions of national currency

AREVENUE (a+b+c+d)966

a)Guarantee fees receivable 256b)Interest receivable555c)Dividends receivable155d)Other0

BEXPENDITURE (e+f+g+h)1170

e)Interest payable (2)1136f)Capital injections recorded as deficit-increasing (capital transfer)0g)Calls on guarantees0h)Other34

CNet revenue/cost for general government (A-B)-204

Part 2 : Outstanding amount of assets, actual liabilities

(4)

and contingent liabilities of general government

Outside general government

Millions of national currency (3)

DClosing balance sheet 402124536018192

a)Loans375010501

0

b)Debt securities (4)8883348590c)Equity and investment funds shares/ units2757900d)Other assets and liabilities of general government entities (5)000e)Liabilities and assets outside general government under guarantee (6)0018192f)Securities issued under liquidity schemes (7)000

g)Special purpose entities (8)0002. Interest payable includes actual interest, where relevant, and imputed interest on financing (see explanatory note).

Country footnotes

Countries may add footnotes to explain their national data.

1……………..….8. Special purpose entities included here are those where government has a significant role, including a guarantee, but which are classified outside the general government sector (see the Eurostat Decision and accompanying guidance note for details). Their liabilities are recorded outside the general government sector (as contingent liabilities of general government).1. This table relates to activities undertaken to directly support financial institutions.It should not include support measures for non-financial institutions, financial institutions not themselves in need of rescue interventions, or general economic support measures (for example, changes in social benefits or changes in tax rates)3. The appropriate valuation for all entries in part 2 is nominal value except for ordinary quoted shares which should be recorded at market value, ordinary unquoted shares which should where possible be valued in line with ESA 2010

§§

7.73-7.79 and debt securities held as assets where market value can be used provided an active market exists and the market value can be reliably determined. In Council Regulation 479/2009, as amended, the nominal value is considered equivalent to the face value. The nominal valuation of certain instruments, notably deposits and various types of bonds, is further specified in chapter VIII.2 of the ESA 2010 Manual on Government Deficit and Debt. 4. By convention, for the liabilities entry under "general government" (which is the impact on Maastricht Debt from activities to support financial institutions), it is assumed that there is a direct impact on government debt from activities which imply a transfer of cash from government (e.g. transfer of cash relating to capital injections, loans granted, purchase of financial assets), except for the impact from direct borrowing. In addition, imputed financing costs should be included. 5. The row 'Other assets and liabilities of general government entities' can include the assests and liabilities of entities that have been reclassified into general government or the assets and liabilities of newly established government defeasance structures. In this case care should be taken to avoid counting the debt effect of the rate of financing twice (see explanatory note).It can also contain assets and/or Maastricht Debt type of liabilities that do not fit on the other lines.In case the line is used a country footnote should be added with an explanation.6. Guarantees covered are those granted by general government to non-general government units. It does not include guarantees on bank deposits, or guarantees on the liabilities of special purpose entities included below. It is only the value of active guarantees, not the announced ceilings for schemes. It also includes guarantees on assets, whereby government would incur a liability in case of a call. 7. Liquidity schemes included here are those where the government securities used are not recorded as government debt (see the Eurostat Decision and accompanying guidance note for details). By convention, they are recorded in part 2 as "contingent liabilities outside the general government", as for guarantees, though it should be noted that the exposure of government is likely to be limited.

General government Assets (D=a+b+c+d)Liabilities (D=a+b+d)Contingent liabilities (D=e+f+g)

Gregorio Abascal

Gregorio Abascal Gregorio Abascal

Gregorio Abascal Gregorio Abascal

Gregorio Abascal Gregorio Abascal

Gregorio Abascal Gregorio Abascal

Gregorio Abascal Mara Ibaceta Figueroa

Mara Ibaceta Figueroa Gregorio Abascal

Gregorio Abascal Gregorio Abascal

Gregorio Abascal Gregorio Abascal

Gregorio Abascal Gregorio Abascal

Gregorio Abascal Gregorio Abascal

Gregorio Abascal Gregorio Abascal

Gregorio Abascal Gregorio Abascal

Gregorio Abascal Gregorio Abascal

Gregorio Abascal Gregorio Abascal

Gregorio Abascal Gregorio Abascal

Gregorio Abascal Gregorio Abascal

Gregorio Abascal Gregorio Abascal

Gregorio Abascal Gregorio Abascal

Gregorio Abascal Gregorio Abascal

Gregorio Abascal Gregorio Abascal

Gregorio Abascal Gregorio Abascal

Gregorio Abascal Gregorio Abascal

Gregorio Abascal Gregorio Abascal

Gregorio Abascal Gregorio Abascal

Gregorio Abascal Gregorio Abascal

Gregorio Abascal Gregorio Abascal

Gregorio Abascal Gregorio Abascal

Gregorio Abascal Gregorio Abascal

Gregorio Abascal Gregorio Abascal

Gregorio Abascal